Hi there!

I'm Libby.

I take the stress out of tax time for individual taxpayers, individuals with side hustles, and small business owners, by keeping up on the latest tax laws and using my knowledge to ensure that you pay the least amount of tax legally possible.

I work with a limited number of clients each year, so I can assure you of individual attention. I want to fully understand your unique situation and I will work to get you every tax advantage you deserve.

Contact me for a free consultation.

Send an email to trustytaxpro@gmail.com.

Why work with me for your tax preparation this year...

- I’ve made it my business to keep up on changing tax laws.

- I work with a limited number of clients so that I can give each one individual attention.

- My bookkeeping background allows me to understand your business – revenue, expenses, profit, etc.

- I specialize in working with individuals who have side hustles that bring in self-employment income.

My tax knowledge journey...

In 2014 we were planning to sell our home and I wanted to know how that would effect our taxes. So I signed up for, and successfully completed, the H&R Block Individual Tax Preparation course. That started me on a journey of learning more and more about individual taxes and I began doing returns for a few family members. Then in 2018, a few years into my virtual bookkeeping practice, I found myself really interested in business taxes and started researching Schedule C completion, and S Corp taxes.

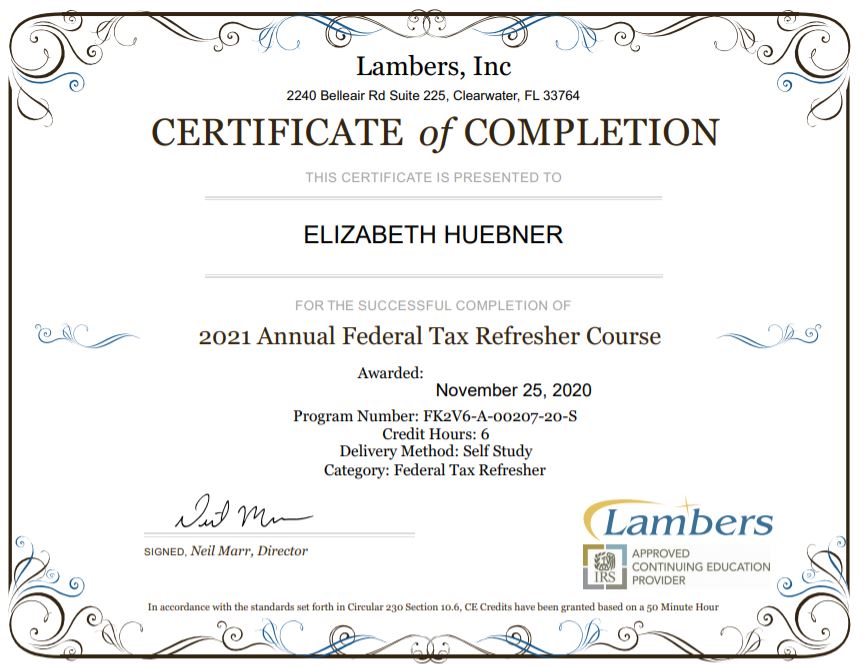

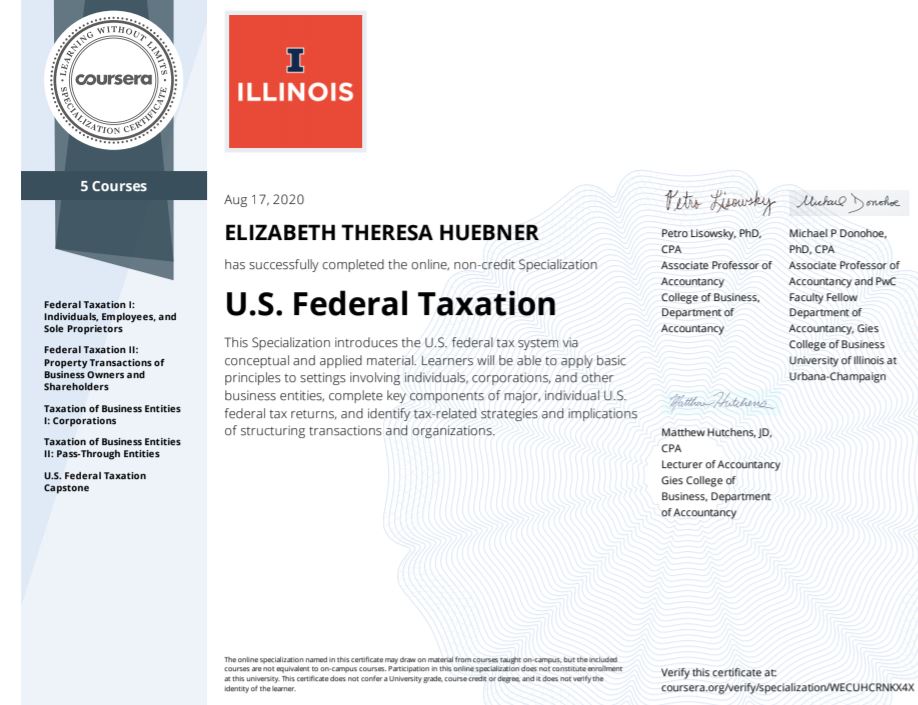

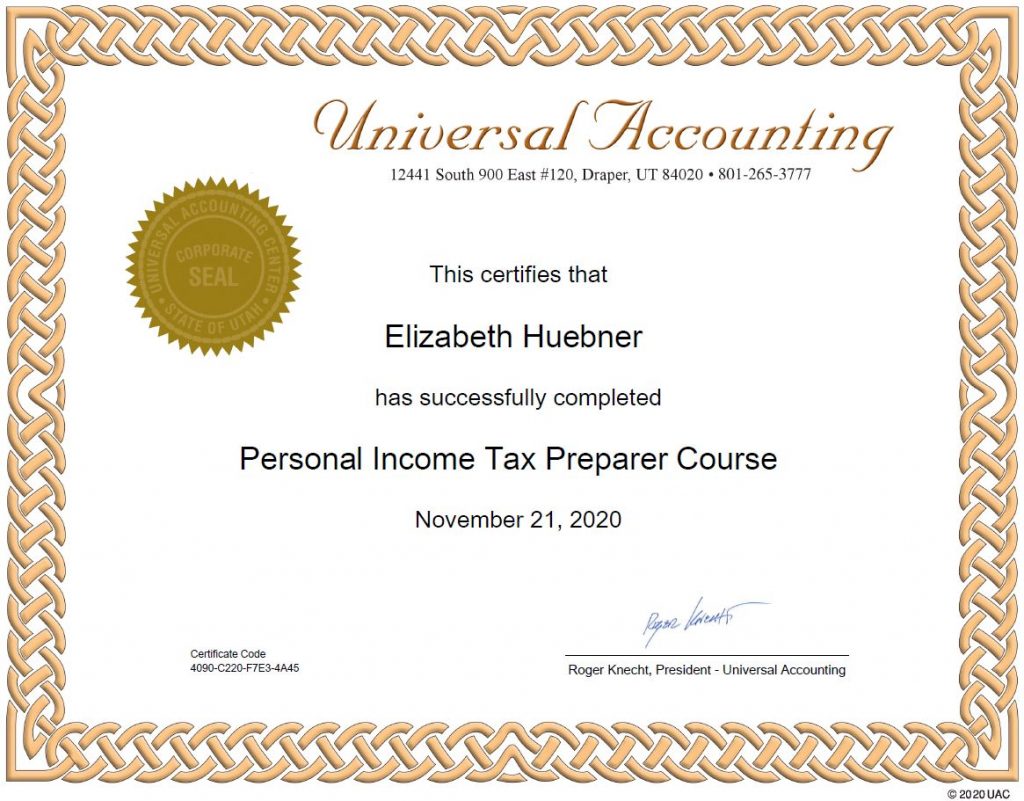

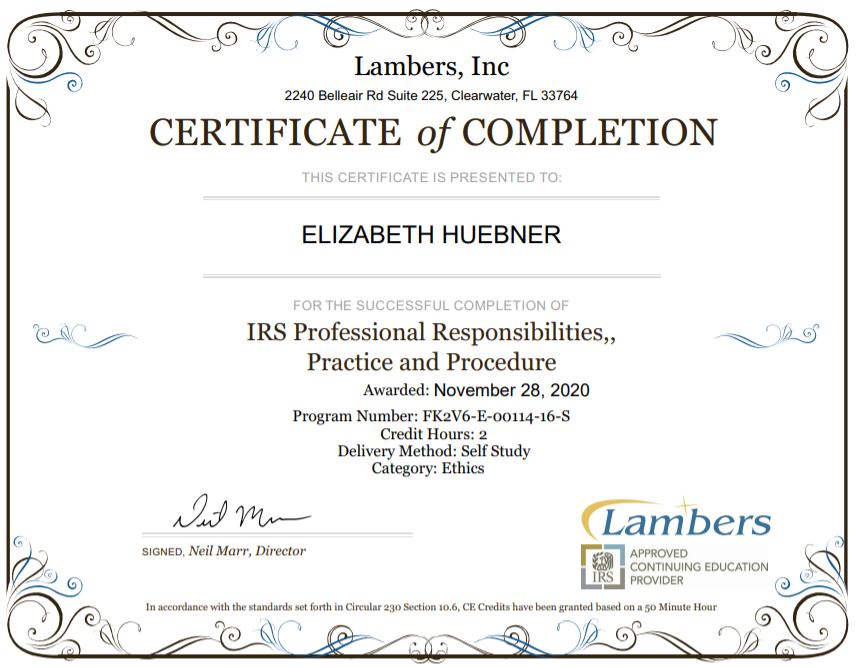

With time on my hands in 2020, I decided to go all in and learn even more about taxes for both individuals and small businesses. I completed the five-part US Federal Taxation course at University of Illinois, the three-part Professional Tax Preparer course at Universal Accounting, and various CPE seminars through Lambers. I also passed the exam to be listed as a preparer in the IRS’s Annual Seasonal Filing Program.

Now I want to put all of my knowledge to work for you and make sure you pay the lowest tax amount legally allowed.

Tax tips you can use this year.

Learn more about the dependent tax credit.

Taxpayers with dependents who don't qualify for the child tax credit may be able to claim the credit for other dependents. This is a non-refundable credit. It can reduce or, in some cases, eliminate a tax bill but, the IRS cannot refund the taxpayer any portion of the credit that may be left over.

Click here for more information.

https://www.irs.gov/newsroom/an-overview-of-the-credit-for-other-dependents

Tax time is prime time for phone scams.

The IRS will never:

- Call to demand immediate payment using a specific payment method such as a prepaid debit card, gift card or wire transfer. Generally, the IRS will first mail a bill to any taxpayer who owes taxes.

- Threaten to immediately bring in local police or other law enforcement groups to have the taxpayer arrested for not paying.

- Demand that taxes be paid without giving taxpayers the opportunity to question or appeal the amount owed.

- Call unexpectedly about a tax refund.

Can we work together without being in the same room?

Absolutely, in fact we can work together even if we are not in the same state, and never meet in person. Click on the contact me page and I can let you know how this works!